For Employers

First Choice is a Preferred Provider Network (PPN) designed by Catholic Health, one the area’s largest and most comprehensive health systems.

With First Choice, you have access to the network of hundreds of participating doctors and medical specialists and dozens of Catholic Health service locations throughout Western New York. That means your employees and their families will get the highest quality care at the lowest possible cost, with more comfort and convenience than ever before.

To Discover How First Choice Can Enhance Your Employee Health

Contact Us At (716) 706-2569

What Is Self Funded Healthcare?

Fully Insured Healthcare Plan

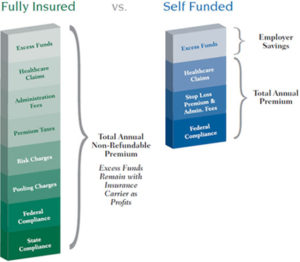

In a traditional fully insured healthcare plan, your company pays a fixed premium determined by the insurance carrier. The annual premium includes charges for healthcare claims, administration fees, premium taxes, risk charges, pooling charges, federal compliance, and state compliance.

Any excess funds are not refunded back to your company and remain with the insurance carrier as profit.

The premium rates are fixed for a year, and your company pays a monthly premium based on the number of employees and their dependents who have enrolled in the plan.

The total monthly premium cost would only change during that year if the number of enrolled employees and/or their dependents in the plan changes.

The insurance carrier company collects the premiums and pays healthcare claims based on your benefit design or the benefit design you have chosen. The employees enrolled in your company’s healthcare plan are responsible to pay their portion of the monthly premium (pre-tax payroll deduction) and the co-payments required at the time they receive healthcare services covered within the policy.

Self Funded Healthcare Plan

In a self funded healthcare plan, your company still pays a monthly premium equivalent rate, similar to those developed by an insurance carrier to cover the expenses of the healthcare plan. These expenses include the costs for administration fees, stop-loss premium, claims, and other negotiated costs.

The employees enrolled in your company’s healthcare plan are still responsible to pay their portion of the monthly premium equivalent (pretax payroll deduction) and the co-payments required at the time they receive healthcare services covered within the policy.

Your company’s monthly costs would also change if the number of enrolled employees and/or their dependents in the plan changes. This is where the similarities between fully insured and self funded plans end and your company’s advantage begins.

In a self funded healthcare plan, your company deposits a monthly amount based on fixed administration fees (no longer based on a percentage of claims), monthly premium collected from your employees, and an amount to cover the anticipated claims. The amount of anticipated claims is partially determined by a healthcare risk assessment analysis of those enrolled based on several factors including medical and prescription claims history.

A stop loss policy is purchased to protect your company from catastrophic healthcare claim expenses. Stop loss coverage protects your company against large claims for an individual as well as an aggregate of claims for the entire group of covered members. The amount of stop loss coverage is determined by a careful analysis of the healthcare risk assessment of those enrolled based on several factors including their claims history.

Simply stated, the total cost of a self funded plan is the fixed costs, plus the claims expense, less any stop loss reimbursements. This prevents your company from paying a non-refundable excess in a traditional fully insured plan. Your company’s savings is the advantage to capitalize on.

First Choice Advantages for Employers

- Lower cost healthcare

- Customized plan design with enhancements on services

- Value based benefit plan design

- Elimination of commissions

Click here to see the First Choice advantages for your employees.

First Choice has provided an outstanding plan and lower medical insurance premiums, which have benefited both the employees and employer.

– Dave Ehrke, Business Manager, St. Leo the Great Parish, Amherst, NY

Quality Healthcare

At Catholic Health, we don’t just talk about quality and value, we make it happen everyday.

Our efforts are nationally recognized by numerous independent rating organizations. These recognitions are an important factor in our efforts to measure ourselves against national benchmarks. They show us that we are on the right track as we compare ourselves to best outcomes and the best health systems across the nation.

On-site Corporate Wellness Programs

A workforce with poor general health can be costly for employers through higher absenteeism and reduced productivity. In conjunction with the cost effective claims management of the First Choice Healthcare Plan, Catholic Health’s Worksite Wellness can provide your employees with customized health and wellness programs, bringing health screenings and wellness education to your place of business.

When you encourage your employees to make lifestyle changes for better health with the assistance of our screenings and programs, your business will feel the results with lower absenteeism, increased productivity, and lower healthcare claims.

Catholic Health will work with you to design customized Worksite Wellness programs to help you accomplish specific wellness goals like reducing the number of smokers in your company. We can also provide on-site flu vaccines to reduce the impact of flu-related absenteeism.

Vision Plus Program Option

You may select an optional discounted vision benefit program through First Choice. Vision Plus provides the following benefits:

- Covered Annual Vision Exam (co-pay applies)

- Free standard plastic eyeglass lenses (first purchase covered in full, additional lenses subject to co-pay)

- Reduction of retail price for eyeglass frames

- Reduction of retail price or reduction of promotional price for laser vision correction

Is the First Choice Plan Right for Us?

We can help determine your potential savings.

We are confident in our ability to determine how the First Choice Healthcare plan can reduce your healthcare plan costs. Our experts will meet with you to review the necessary information needed to conduct a risk assessment. Our experts will provide a careful analysis to help determine your company’s potential savings. We will be with you every step of the process with a performance guarantee.

Catholic Health can answer any of your questions to ensure your complete understanding and confidence about the First Choice Healthcare plan. We believe in most cases that there will be significant healthcare plan savings and we are experiencing the savings with our own First Choice Healthcare plan. Our savings help us invest back into our own healthcare facilities which ensures our continued commitment to excellence and leading the transformation of healthcare in our community. What will your company do with your savings?

Contact us at (716) 706-2569 to discover how First Choice can enhance your employee health coverage.

View My Plan

To Login and View Your Plan.